Beijing Frontier Institute of Regulation and Supervision Technology (FIRST),

Sinai Lab from Academy of Internet Finance (AIF), Zhejiang University,

Zhejiang University International Business School (ZIBS),

Institute of Data & Risk, Zhejiang University (IDR),

Zhejiang Association of Internet Finance (ZAIF)

are pleased to release the Global Fintech Hub Report with the key findings as below.

The Global Fintech Hub Report 2020 is an index report jointly published by Beijing Frontier Institute of Regulation and Supervision Technology (FIRST), Sinai Lab from Academy of Internet Finance (AIF), Zhejiang University, Zhejiang University International Business School (ZIBS), Institute of Data & Risk, Zhejiang University (IDR), and Zhejiang Association of Internet Finance (ZAIF) on September 8th, 2020.This report selected the worldwide Top 40 cities in FinTech development out of about 80 cities through comprehensive index from three angles of FinTech Industry, Consumer Experience and Ecosystem, to present global FinTech map and its future trend. We also respond to three questions: “Should we Develop FinTech or Not”, “Which Types of FinTech to Develop”, and “How to Develop FinTech for Different Cities”.

The theme of this report is “When Thousands of Boats Compete to Sail, the Best Built Wins” (A Chinese Saying). In this phrase, “Thousands of Boats Compete to Sail” represents current situation of FinTech developments, where every country competes actively for a spot in the race. “The Best Built Wins” is our answer to the question that “How to Develop FinTech for Different Cities” – it is important to get the first mover advantage as well as polished tools when competing with others. Furthermore, the phrases “best built” refers to the prosperous market, to advanced technology, and to great regulation.

2020 Ranking

The 2020 Global FinTech Map: 8+32+N

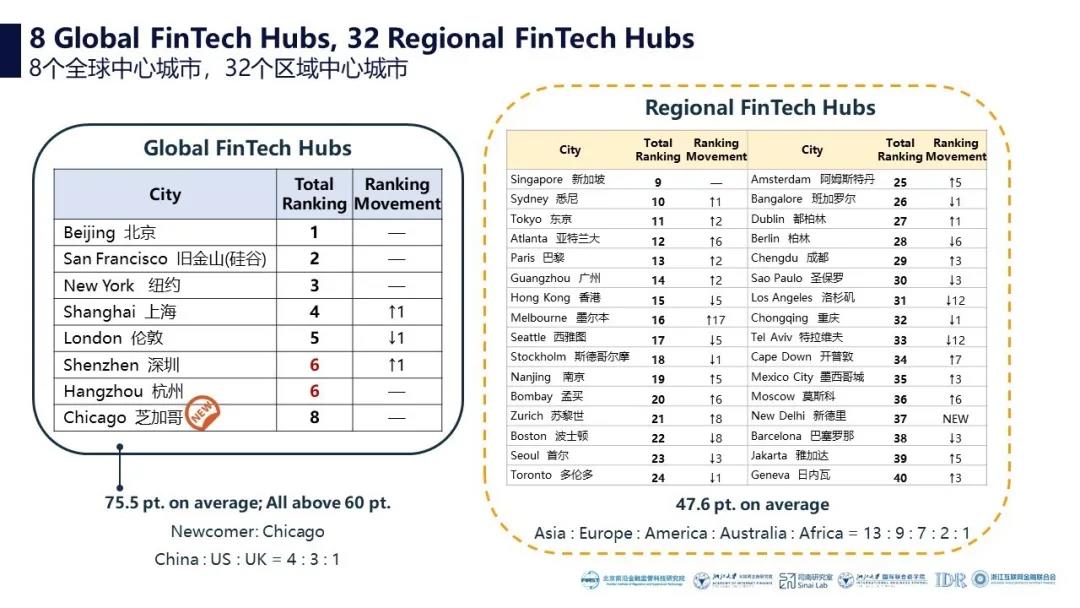

This report selected the worldwide Top 40 cities in FinTech development out of more than 70 cities, and further classified them into 8 Global FinTech Hubs, 32 Regional FinTech Hubs, and several Emerging FinTech Hubs that are not in the Top 40. Specifically, the number of Global FinTech Hubs increased from seven in 2018 to eight in 2020. Beijing, San Francisco (Silicon Valley), New York, Shanghai, London, Shenzhen and Hangzhou maintained their Top 7 status, Shanghai won over London to become No. 4, Shenzhen and Hangzhou are equal in No. 6, where Chicago grew significantly to enter the top tier in global FinTech development, it is now No. 8. Asia and Americas lead the global FinTech development. Within the eight Global FinTech Hubs, China and the US continue to be the G2, China takes up four places, the US three, and with London, the UK takes up one. Among 32 Regional FinTech Hubs, 13 of them are Asian cities (40.6%), Europe increases by 3 cities to 9 cities, which is a significant improvement. Americas and Australia take up seven and two places, respectively. Africa broke its zero record, Cape Town (ranked No. 34) moved up for seven places and get listed for the first time.

All Global FinTech Hubs have scored above 60 points, their average score is 75.6 points, 27.9 points higher than the average score for Regional FinTech Hubs (47.6 points). From the perspective of high quality FinTech companies, the eight Global FinTech Hubs attracted 72.6% of listed FinTech companies, and 91.9% of market capitalization; as well as 69% of the world’s highly capitalised unlisted FinTech companies (unlisted FinTech companies with Venture Capital exceeding USD 50 Million) and 77.4% of total funds raised. They are leading roles in FinTech. Further, on the FinTech racetrack, new stars emerge–Melbourne, Zurich, Amsterdam, Cape Town, Atlanta and Mumbai improved significantly.

The Industry Rankings:Chinese Cities Shine

Out of the first 20 cities in the Top 40 Global FinTech Cities by Industry, other than five Chinese cities, the others are cities from developed countries. Although FinTech development depends on the endowments of the city, if cities capture the new opportunity like the Chinese cities, they could leapfrog and overtake to lead from a different lane. Geographically, Asia, Americas and Europe cover the list, taking up seven, six and five cities respectively.

FinTech Consumer Experience: Developing Countries Lead in All Aspects

Relying on a large market size and number of application scenarios, Chinese cities are still the benchmark for FinTech consumer experience, taking the top eight places in the global FinTech consumer experience ranking. Countries such as India, South Africa, and Russia are putting resources into improving financial inclusion, together with Chinese cities, they take the top 15 places. From the perspective of continent, Asia has an excellent performance by acquiring 13 places of top 20 cities; Europe, Americas, and Africa take up four, two, and one places respectively.

FinTech Ecosystem: The Top Priority in FinTech Development

FinTech ecosystem ranking is significantly correlated with the industry ranking; the Top 20 cities continue to come from China and developed countries, and almost all Chinese cities have improved their rankings, evidencing that a good FinTech ecosystem is the most important factor in FinTech development. From the perspective of development models, these cities either focus on financial services companies developing their own technology, or technological companies empowering financial services, or focusing equally on both. Geographically, Asia takes 9 places, Europe, Americas, and Australia take six, three, two respectively.