Academy of Internet Finance (AIF), Zhejiang University

In partnership with

International Monetary Institute(IMI), Renmin University of China & Institute of Finance Research(IFR), Zhejiang University

In the past year, the global economy has continued to recover and total demand has rebounded, but economic downside risks remain. In the meanwhile, the shift in monetary policy, the deterioration of the debt backlog, and the anti-globalization trend have become hidden dangers of economic growth. In an environment where opportunities and challenges coexist, how do banks in various countries devote themselves to international development and how the level of internationalization of global banks change? “The Internationalization of Global Banks” series of reports continue to focus on the bank's overseas assets, revenue, and branch performance, demonstrating the internationalization of major banks around the world by the Bank Internationalization Index (BII). As the fourth phase of the series of reports, 2018 Bank Internationalization Report selects 106 banks from 38 major economies for in-depth analysis. The total assets of these banks in 2017 were about 70 trillion US dollars, accounting for 86% of the global GDP of the year. From developed countries to developing countries, from Europe, America, to Asia and Africa, they include major banks in major economies, and represent the status quo of the global-banking-industry internationalization.

I Most International Banks

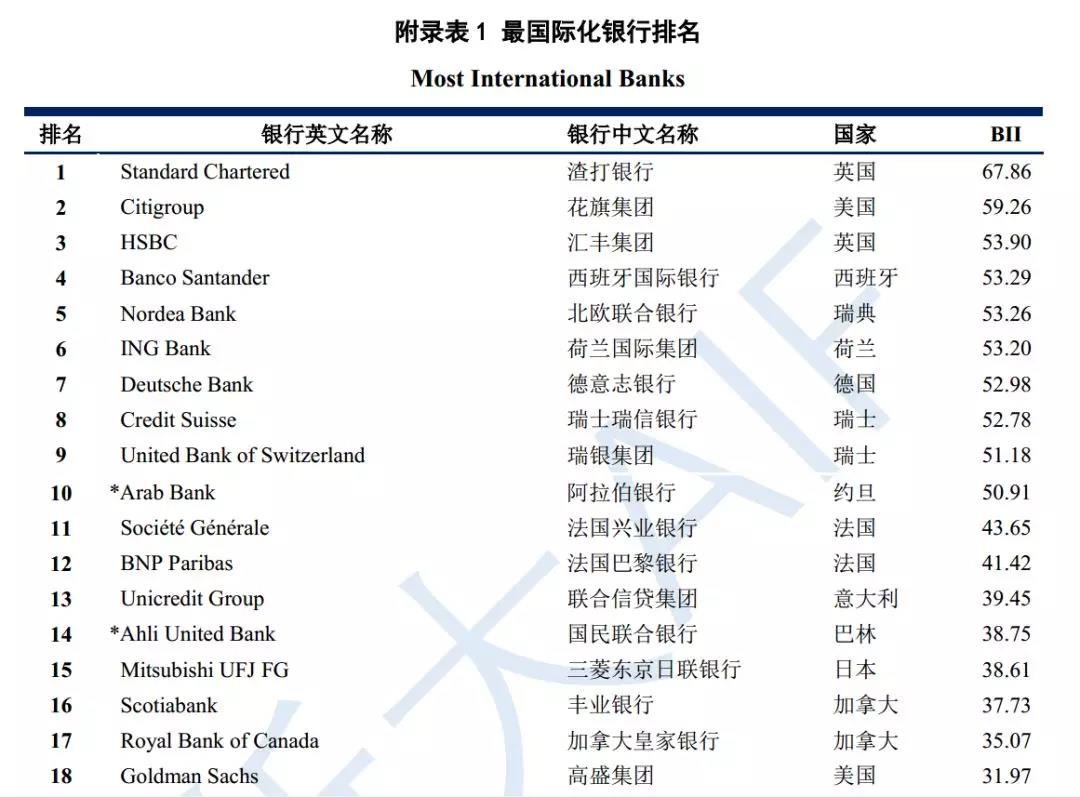

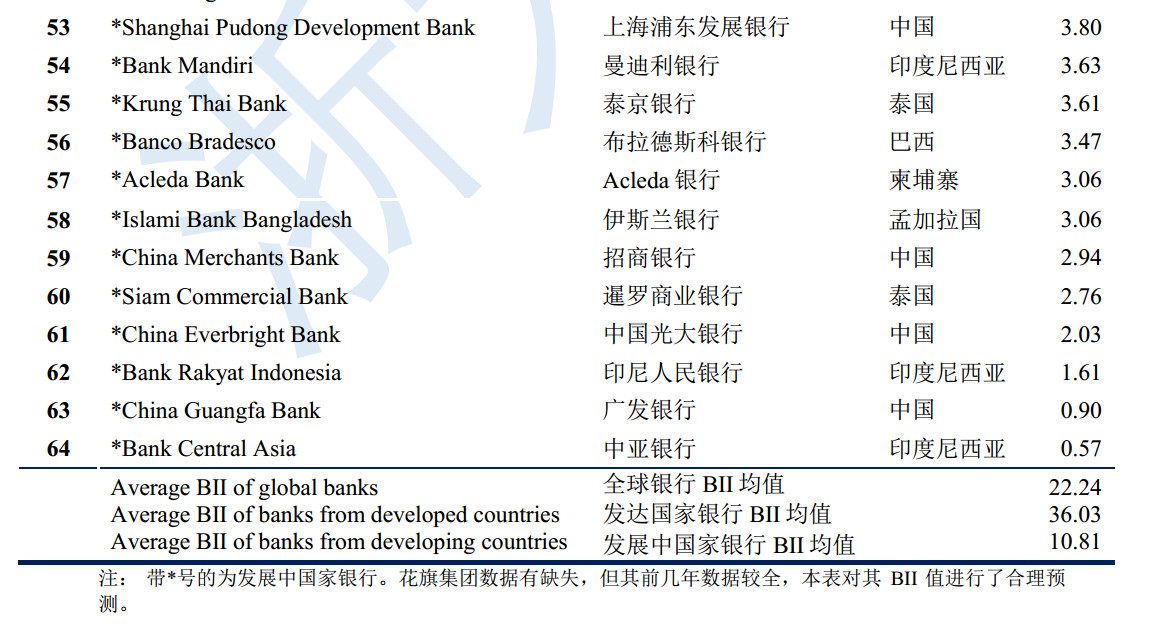

In 2017, we selected 64 banks with a relatively comprehensive overseas data (total assets of approximately $53 trillion, about 65% of global GDP) to conduct BII rankings, which shows the internationalization level of each bank.

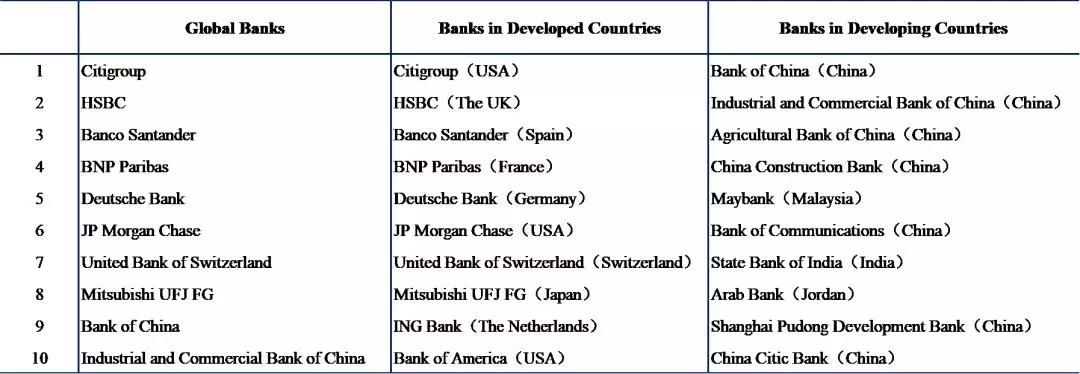

Table 1 Most International Banks in 2017 (Top 10)

Note: Citigroup's data of 2017 is missing, but its previous years' data is relatively complete. In this table, a reasonable prediction of its BII value is made.

The most international banks are mostly from developed countries. In 2017, 9 of the top 10 global bank BIIs were from developed countries. BII measures the internationalization level of banks based on the proportion of overseas business data of banks, which is the “most internationalized bank”, and the ranking performance reflects that the current multinational banks on the international stage are still dominated by developed countries with more internationalized history.

The level of internationalization of banks in developed countries is generally high. The BII value of the top ten developed countries' banks is basically more than 50 points. The overseas development is as important as the domestic territory and even surpasses the domestic development. Due to the small size of the domestic market and the close geographical relationship, the European regional banks generally have a high level of internationalization, occupying nine seats in the top ten banks in developed countries.

The level of internationalization of banks in developing countries is uneven. On the one hand, among the top ten in developing countries, only the Arab Bank BII reaches the value of 50 points, and only five banks BII value exceeds 20 points, which show that the overall level is low and the gap between banks is large. On the other hand, among the top ten, Jordan, China, and India each have two banks. Geopolitical relations, religious culture, and domestic economic development all have a great impact on the internationalization of banks.

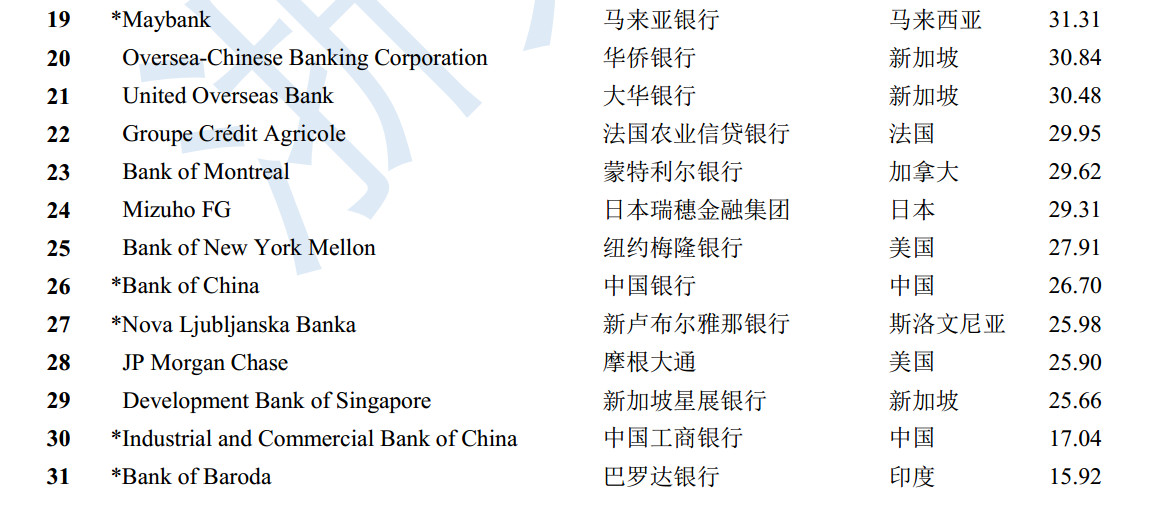

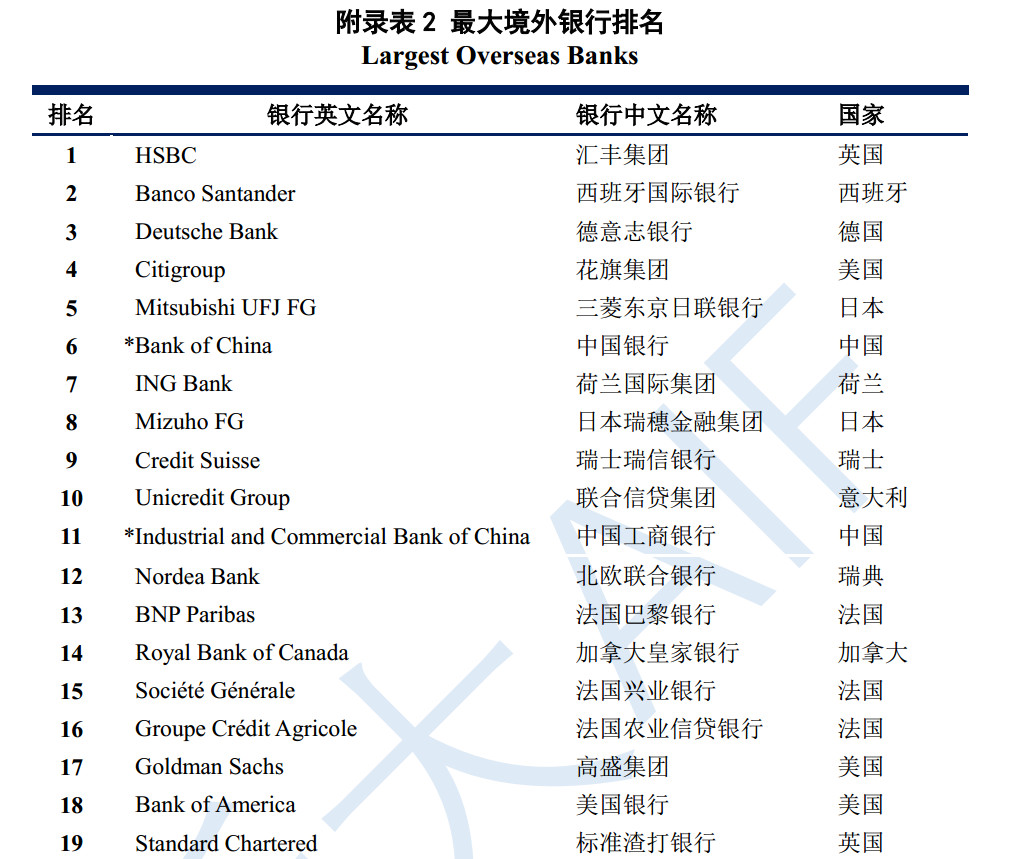

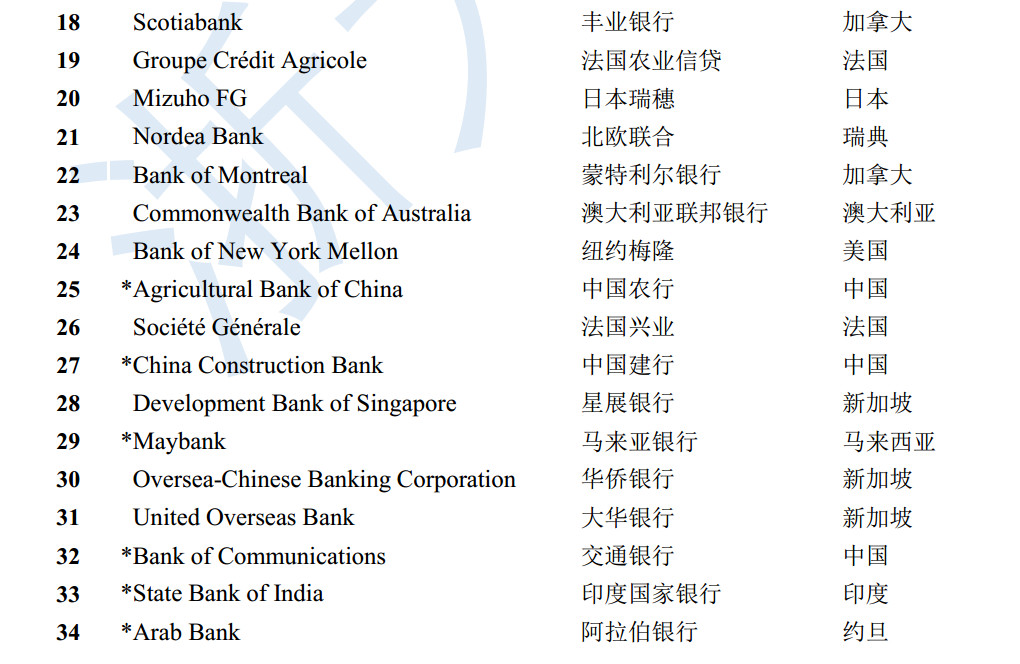

II Largest Overseas Banks

We use the overseas assets of banks to represent the scale of overseas banks, and we have the “largest overseas banks” ranking.

Table 2 Largest Overseas Banks in 2017(Top 10)

Note: All bank overseas asset data is converted into US dollars at the exchange rate of the bank's balance sheet date, and then the offshore asset scale is ranked. Citigroup's data in 2017 is missing, but its data in previous years is relatively complete. In this table, a reasonable forecast for the scale of its overseas assets is made.

The scale of overseas bank assets is huge. The total size of the 64 banks overseas assets is about $15.1 trillion, exceeding the total GDP of China in 2017 (about $12.2 trillion). The top ten banks’ total overseas assets reached $9.1 trillion, accounting for more than half of the total overseas assets of all banks.

The scale of overseas assets of developed countries' banks far exceeds that of developing countries. Among the top ten overseas assets, nine of them are from developed countries, and the total assets of 29 developed countries’ banks are about $12.7 trillion, which accounts for 84% of the world’s overseas banks, and is more than five times the scale of the total assets of 35 developing countries’ banks ($2.4 trillion). Among the banks in developed countries, the scale of overseas assets of banks in Europe and the United States is relatively large, and the performance of Japanese banks is prominent as well.

China has become the developing country with the largest overseas assets of banks. As of the end of 2017, the scale of overseas assets of major banks in China exceeded US$2 trillion, exceeding the total GDP of Italy in that year. Bank of China, ranked as the only developing country bank to enter the top 10 of the global overseas banks, ranking sixth, and China became the only developing country to gain a place in the top ten of the “largest overseas banks” and it takes 7 seats out of the top 10 banks from developing countries.

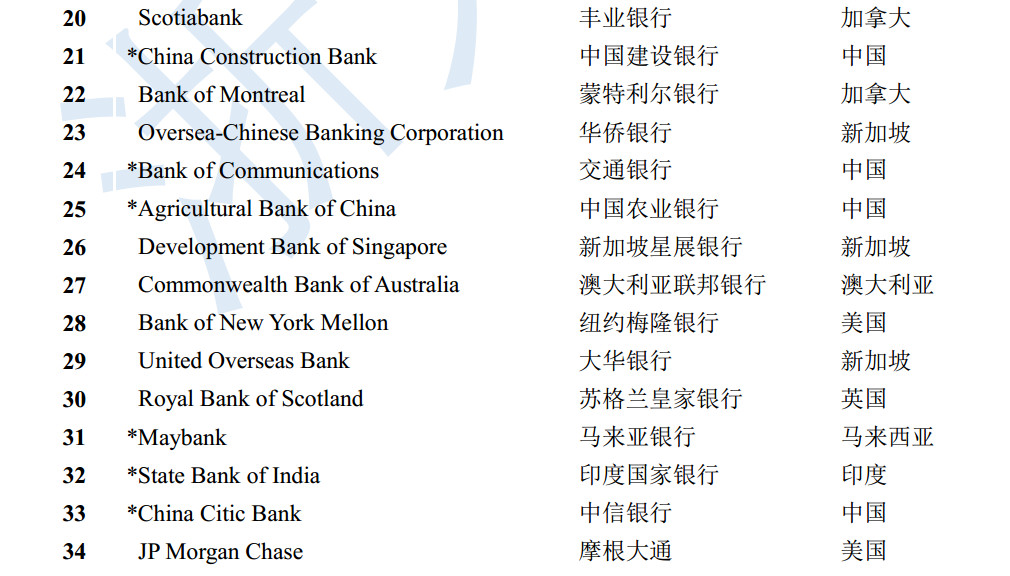

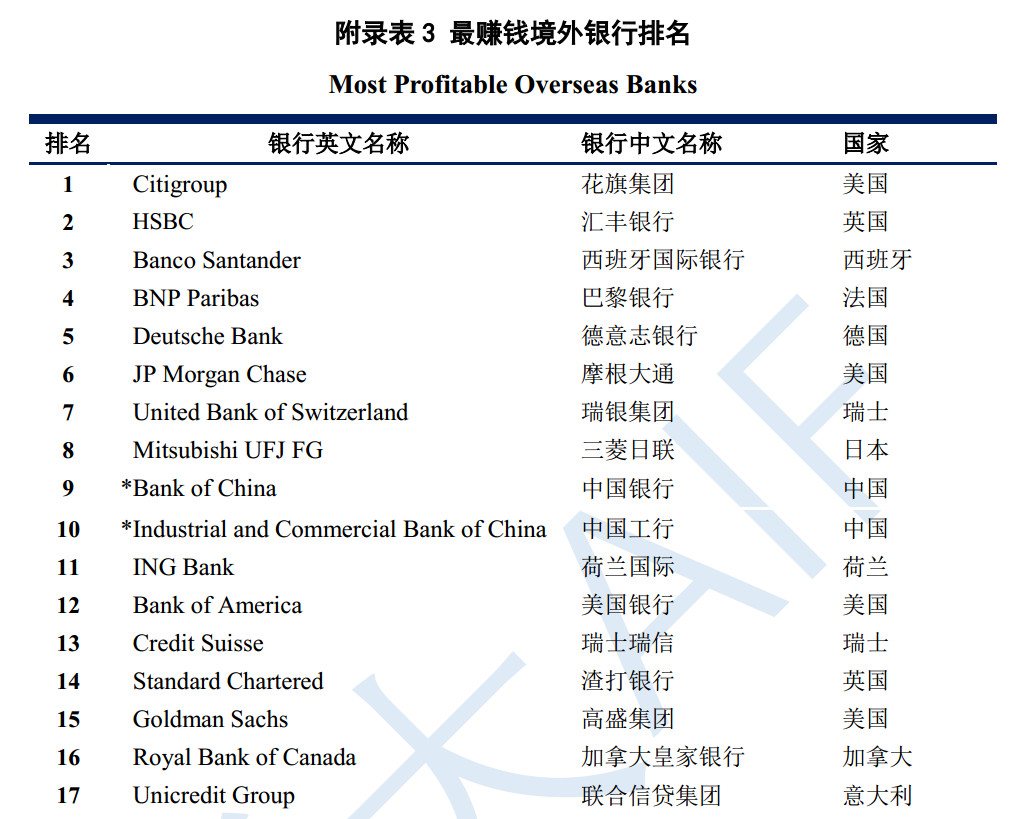

III Most Profitable Overseas Banks

We use the bank's overseas revenue scale to represent the operating results of overseas banks, and we have the highest-revenue-bank ranking.

Table 3 Most Profitable Overseas Banks in 2017(Top 10)

Note: All bank external revenue data is converted into US dollars at the exchange rate of the bank's balance sheet date, and then the overseas revenue scale is ranked.

The global bank's overseas operations have achieved remarkable results. The total overseas revenue of 64 banks is about $490 billion, which is approximately equal to 30.8% of the total operating income of all banks. The top 10 banks have total overseas revenues of $300 billion, which exceeds the total overseas revenue of the remaining 54 banks.

The overseas operations of banks in developed countries are better than those in developing countries. Among the top 10 overseas revenues, 8 are from developed countries, and the total overseas revenues of 29 banks from developed countries are close to $430 billion, accounting for 87.8% of the total overseas revenues. It is more than seven times the size of the overseas bank revenues of 35 developing countries ($60 billion). Moreover, the overseas revenues of developed countries accounts for 3.4% of its overseas assets, which is higher than the overseas assets income rate of developing countries (2.5%), and the overseas business capacity is higher.

The BRICS Banks represent the highest level of the overseas development of banks. Among the 35 banks from developing countries, 15 are from BRICS. And their overseas revenue is close to $53 billion, accounting for 88% of the total overseas bank revenue of 35 banks, leading the international development of banks in developing countries. As a prominent representative of emerging economies, the BRICS is increasingly influential around the world, and the international activity of financial institutions is increasing as well.

IV Different Choices of Internationalization

We use the BII values of 106 banks for nearly a decade to describe the international development of the global banking industry. Among them, 42 banks are from 15 developed countries, and 64 developing country banks, from 23 countries.

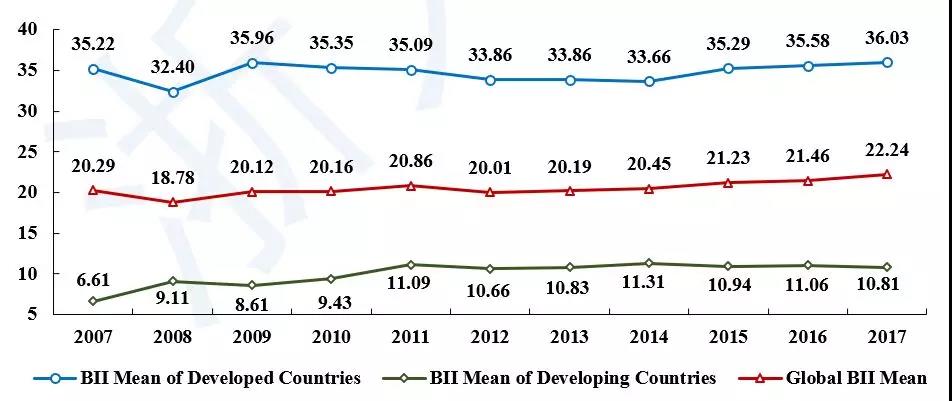

Note: This chart is based on 106 banks, and some banks BII are default values in individual years.

Figure 1 Global Bank BII Mean Fluctuation from 2007 to 2017

The internationalization level of the global banking industry has been less volatile in the past decade, and since 2012, the internationalization level has generally increased. On the one hand, the economic growth rate has rebounded in recent years, and the steady development of major economies, the recovery of global trade and investment, the expected improvement of financial markets, and the improvement of internal and external environment have become the driving force and premise for banks to expand overseas actively. On the other hand, although protectionism’s threat to development is not diminished, close exchanges between regions are still going on, such as economic and trade exchanges in the Pacific Rim and frequent cooperation between the European Union and countries along the Belt and Road. They all provide important opportunities for the overseas development of enterprises and financial institutions in various countries.

About 30% of systemically important banks have declined in internationalization, and many reasons have prompted some banks to transform their international expansion strategies. First, banks are more cautious because of the risen counter-globalization and trade protectionism, the exploded geopolitical conflicts, and the accelerated accumulation of risk factors and uncertainties. Second, financial supervision has become stricter. Since 2015, the Financial Stability Board has adopted the Principles and Clauses for Total Loss Absorptive Capacity to improve the compliance difficulty of systemically important banks to maintain growth effectively. Third, the development strategy has changed. More banks have begun to focus on “quality” from “quantity”. Compared with scale expansion, they have paid more attention to the optimization of asset allocation and the improvement of layout structure.

In conclusion, in 2017, the global economic situation is still complicated, the internationalization of the global banks is on the rise, some banks are actively taking international steps, and some banks have carefully adjusted their global strategies and formed a multi-level internationalization pattern. In the future, in an environment where the status of internationalization is still unclear, banks should carefully formulate an internationalization strategy to achieve not only “going out” but also cross-border risk prevention, and be good at using various regional cooperation opportunities to enhance the level of internationalization as well.