导读:近日,浙江大学互联网金融研究院院长贲圣林教授受邀参加由印度外交部及印度观察研究基金会(Observer Research Foundation,ORF)在新德里举办的2016年瑞辛纳对话(Raisina Dialogue),并在ORF特刊上发表题为《更坚实的亚非关系是全球的机遇》一文。贲教授指出,亚洲和非洲存在诸多相似之处:基数庞大且不断增长的人口,众多的发展中国家,丰富多元的文化,曾被外国殖民的历史经历……但两者的相似之处似乎又只止于此。近代以来,它们天差地别的经济命运与发展轨迹可谓是超乎想象——亚洲如日中天的迅猛发展让非洲只能望其项背。是什么带来了如此巨大的分化?究其原因,除和平与安全这一关键因素外,贸易、金融和技术等因素也各自起到了至关重要的作用。建立更坚实的亚非关系不仅会给非洲带来发展的机遇,也将带动亚洲乃至世界的发展。而毫无疑问,中国所提出的“一带一路”战略便是这样一个能让非洲及全世界变得更加美好的全球性历史契机,它不仅有助于进一步巩固中非友好关系的传统,也将有助于持续深化中国在亚非合作关系中所扮演的领导角色;不仅引起了国际社会的广泛关注,也带动了地域政治联合体之间的健康竞争。

Abstract

Asia and Africa are similar in many ways: big and growing populations, largely developing countries, rich and diverse cultures, histories of foreign occupations …… However the similarities seem to end there. Their recent economic fortunes and growth trajectories have been as divergent as one can imagine, with Asia considered the poster child of development and Africa falling behind further ever. What are the key factors behind their divergence? Though peace and security are crucial factors that have set them apart, connectivity factors such as trade, finance and technology have played differentiating roles as well. Building a stronger Asia-Africa connectivity will benefit not just the development of Africa, but also that of Asia and the rest of the world. China’s recent rollout of the so-called One-Belt-And-One-Road strategy has further sharpened its traditional focus on African friendship and its intensified effort to play a leading role in Asia-Africa partnership has caused some international concern and stimulated some healthy competition for geopolitical alliances and African partnership, which is an opportunity the world should seize to make not just Africa but the whole world a better place.

Why nations prosper and fail have fascinated people from all walks of life, from “development economists” to historians and cultural experts, from social and political scientists to political leaders. Various initiatives have been undertaken to unlock the growth potential of the developing countries, including the establishment of multilateral, both regional and global, institutions, with World Bank being probably the most prominent example and AIIB (Asia Infrastructure Investment Bank) and NDB (New Development Bank) being the most recent endeavors.

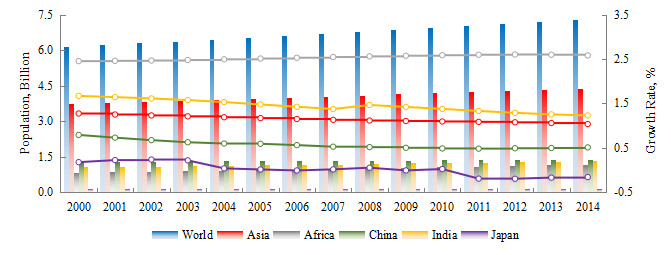

In the world of “development economics”, there has been increased and particular focus on Asia and Africa due to not just the importance of these two regions in terms of populations (See Fig 1 below) and those in poverty, but also the Asia’s perceived successes and strategies in contrast with Africa’s pitfalls and potential, and the possible lessons for Africa to realize its untapped potential.

Fig 1 Asia & Africa Account for 75% of World Population and Still Increasing

Source: (1) United Nations Population Division. World Population Prospects, (2) United Nations Statistical Division. Population and Vital Statistics Reprot (various years), (3) Census reports and other statistical publications from national statistical offices, (4) Eurostat: Demographic Statistics, (5) Secretariat of the Pacific Community: Statistics and Demography Programme, and (6) U.S. Census Bureau: International Database

Asia and Africa are expected to continue their leadership in the growth of population, due to the increasing availability of improving health care, positive demographic trends and recent relaxation of one-child policy restriction in China.

1. Asian Success and African Potential

While the vast diversity of Asian and African nations means the risk of generalising the analysis by simply focusing on the two aggregated regions to draw the broad conclusions, this over-generalisation is partially mitigated with inclusion of Asia’s Big Three (China, India and Japan), South Africa and Egypt in our analysis given their significance, diversity and data availability.

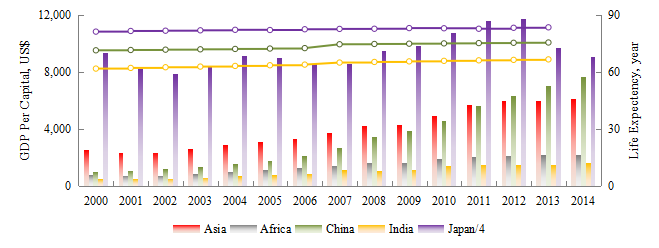

Fig 2 GDP Per Capita, Life Expectancy of Asia and Africa

Source: World Bank national accounts data, and OECD National Accounts data file

Note: Japan’s GDP per capita in the graph is its actual divided by 4 for better illustration.

It must be hard for many to believe the following salient points:

-In 1970, Asia was a bit more than five times of Africa in terms of nominal GDP, today their gap has doubled with Asia equal to 10 times of Africa

-In 1970, Africa’s nominal GDP per capita was similar to Asia’s and more than two times of China’s; today African’s average is less than 30 percent of China’s; China and Africa were at par in terms of GDP in 1970, today China is five times of Africa.

-During the same period of time, India was able to narrow its gap with Africa from nearly 50 percent to about 20 percent today, in nominal GDP.

-In terms of life expectancy, Egyptians and South Africans lived longer than Chinese and Indians in 1960; today a Chinese can expect to live nearly 5 years and 20 years longer than his Egyptian and South African counterpart respectively, while an Indian can expect to live 10 years longer than a South African. The gap between a South African and Japanese in terms of life expectancy has also doubled since 1970. Considering South Africa is among the more developed nations of Africa, we can safely say that the gaps between some other African nations and Asia are even wider and discomforting.

2. The Three Dimensions of Connectivity

The Asia-Africa gaps represent both the huge progress that Asia has made in its development efforts and the significant opportunities for Africa. Various studies have been undertaken to identify the key success factors behind Asia’s success and what can be replicated to Africa.

While there are important and non-economic factors behind the vastly divergent economics performances of the two regions, connectivity or the lack of it seems to explain a significant part of their divergence. Among the various elements of connectivity, trade, technology and financial appear to have played the pivotal roles.

2.1 Trade

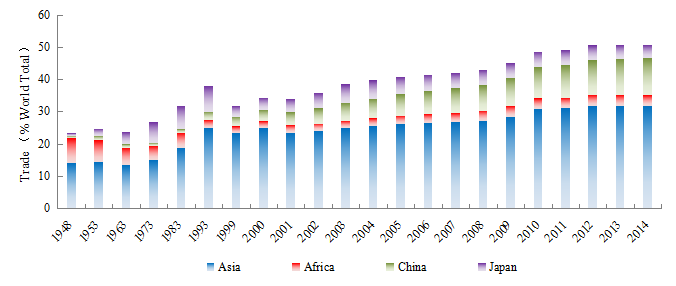

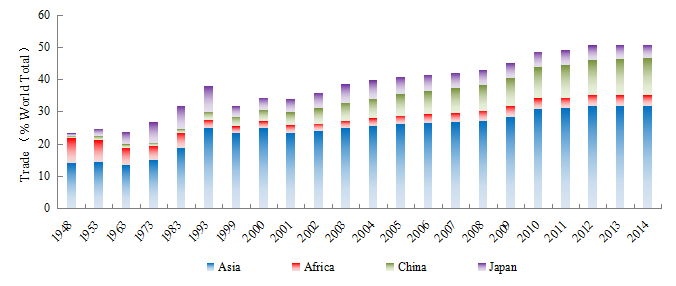

Fig 3 Trade Connects the World: Asia, Africa, China & Japan

Source: WTO Statistics Database

From Fig 3, what is striking is that Africa’s role in world trade has declined significantly since 1948. Its share of world exports and imports fell from 7.3 percent and 8.06 percent in 1948 to 3 percent and 3.44 percent in 2014, representing a sharp deterioration of its position in the global value chain of trade and its “connectivity” with the rest of the world.

In contrast, Asia has expanded its role of world trade, taking 32 percent respectively of total global exports and imports today, from a more modest 13 percent and 8 percent in 1948. It is no wonder that Japan, the four Little Tigers of Asia, and China have all successfully pursued the export-led growth strategies,according to the World Trade Organisation data.

2.2 Technology

Fig 4 Technology Connects The World: Internet Penetration Ratio

Source: International Telecommunication Union, World Telecommunication/ICT Development Report and database, and World Bank estimates

Though data on the regional level and many individual African countries are not available, Fig 4 shows the internet users as a percentage of total population in different countries and regions. It is noteworthy that China had a relatively late start and were not able to catch up with the world until 2009; today China is well above the world average, with over 50 percent of Chinese connected to internet.

What is equally striking is that South Africa has played an excellent catch-up game and its internet penetration ratio is now comparable to China’s. Egypt has also improved fast and it is now ahead of India, though below the world average. The mobile technology probably represents an unprecedented opportunity for a “latecomer” Africa to leapfrog many of the now outdated technologies. The disruptive nature and equalizing effect of the new technologies means literally that the world is flat and Africa, for the first time, can be as easily accessible and visible on the world map as any other nation or region.

2.3 Finance

Technology and finance are considered two pillars underpinning the development of countries and corporate successes alike. How inclusive is their financial system is an indicator of both the level of social development and how strongly finance empowers the people and thus their nation to achieve the economic success and social justice.

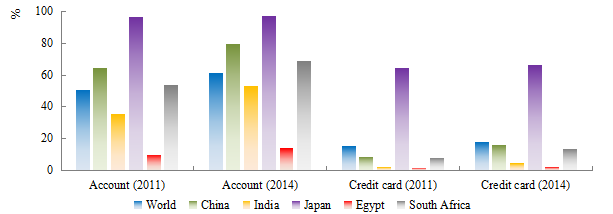

Fig 5 Financial Inclusiveness: Bank Account and Credit Card Penetration Ratio

Source: World Bank Global Financial Inclusion Database

In terms of number of bank accounts and credit cards per 100 adults (age 15 or above), China and South Africa are leading the “financial inclusiveness” index, with India falling substantially behind the world average and Egypt failing miserably in the ranking. Those who are excluded from the formal financial system are missing out the opportunities for themselves, which also constrains the government’s ability to facilitate entrepreneurship and cultivate broader base for taxation.

The cure to this problem may lie in “internet finance” in China (better known as FinTech outside China), the combination of technology and finance thanks to the exciting progress made in the Big Data and cloud computing powers. The much talked-about developments in FinTech space such as blockchain promise to revolutionize the way financial services are provided and are probably the best bet for Asia and Africa to achieve financial inclusiveness and equality with the developed world. The mass market customers, or the so-called microfinance customer segments, have been unbanked or under-served by the traditional financial services firms due to efficiency constraints. They will now have access to similar, if not the same, level of financial services thanks to FinTech’s cost-effectiveness and decentralized business model. Developing countries like China provide fertile ground for applying such innovative solutions without the powerful incumbency of traditional financial sector and some of them appear to be leading in this new area.

3. The Opportunities for Asia-Africa Partnership

After making strides over the past decades, China and many other countries in Asia are facing the challenge of “middle income trap”. Politically, the much-needed intra-Asia cohesiveness is sorely missing; Asia is now home to some of the most dangerous hotspots of geopolitical tensions in the world. What has helped Asia achieve economic growth includes the general peaceful environment and security arrangement in the region for the past few decades - a point that many people may have forgotten. The lesson that Africa must learn in order to achieve sustainable economic development is that security and stability are prerequisites for economic growth, even before technology, finance and trade.

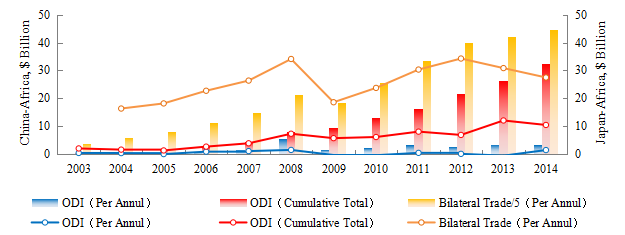

Asia-Africa Partnership is flourishing and is expected to gain additional momentum given the shaper focus placed by Asia, in particular China, India and Japan. While Japan started investing in Africa earlier, it is China that has moved faster. Despite as a latecomer, China has so far invested USD 32 billions, three times of the total of Japanese investment in the region. In terms of trade, China has quadrupled its export to Africa over the past 20 years, exceeding $100 billions each year in both 2014 and 2015, while imports from Africa saw a five-fold growth in the same period of time. Japan’s trade with Africa is dwarfed by China’s, with exports and imports totaling $27 billion in 2014, according to data from World Bank and World Trade Organization.

Fig 6 Asia-Africa Connectivity: Investment & Trade

Source: World Bank data, WTO Statistics Database

China has launched “One Belt and One Road” (OBOR) initiative, which is expected to cover most of Asia, Europe and extend further into Africa. One of its particular focuses is “connectivity”, in terms of trade and investment, infrastructure, technology and people. This means improving “Intra-Asia” cohesiveness as well as strengthening inter-regional connectivity such as Eurasia and Asia-Africa partnerships. To support these and encourage alternative development paths, China had led the launch of AIIB and NDB with a particular focus on infrastructure. NDB has even planned a regional office in South Africa, signaling its commitment to foster closer Asia-Africa partnership. China’s proactive OBOR policy has attracted some international misunderstanding, closer scrutiny and even competition, the latter of which is probably unintended but is nevertheless good for Africa and developing world in general. OBOR as China’s vision for inter- and intra-regional partnership, and AIIB among the alternative funding vehicles to support OBOR, their roll-outs have helped the world, including India, Japan and the United States to sharpen their focus on closer inter-regional partnership with Africa., The world, and Africa in particular, should welcome and will benefit from more and closer partnerships.

The author wishes to thank Jiamin (Jamie) Lv,Eddie Brient, and Sadar Usman

PhD Students at Zhejiang University for their research assistance to this article