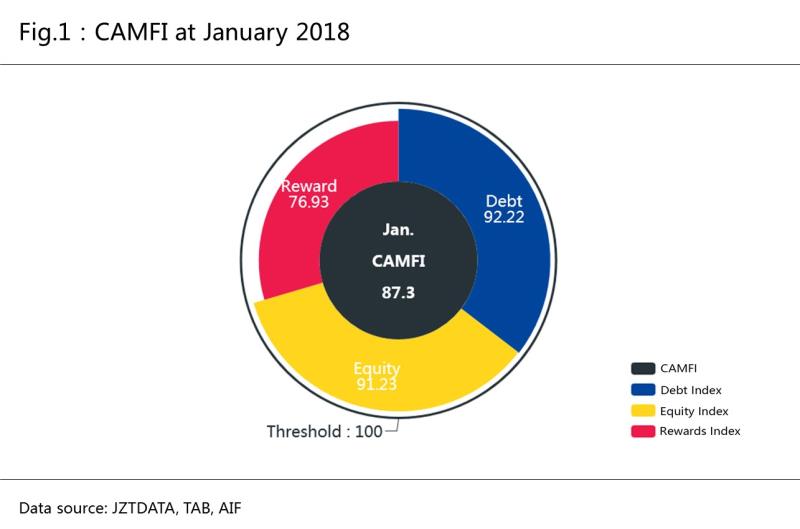

As a composite index, CAMFI tracks each of the major industry segments’ development. Overall, CAMFI’s sub-indices show the trend that two dropped and the other rose in January:

Debt-Index: dropped from 93.32 in December to 92.22;

Reward-Index: decreased significantly from 99.52 in December to 76.93;

Equity-Index: slightly increased from 85.49 in December to 91.

The global crowdfunding and marketplace finance industry remained depressing in January. CAMFI dropped to below the 100 threshold last month and continued contracting in January. The index fell from 92.82 in December to 87.30 and hit a record low. Segment-wise, the Reward-Index was the main driver of CAMFI’s fall in January. According to the data, the Reward-Index plunged in January and fell to its lowest level since May 2017. The Index fluctuates violently and the industry may face greater downward pressure.

The CAMFI index declined for three months. The China Marketplace Lending Index increased from 91.72 in December to 93.07. The industry contracted less than last month, but the index value was still below 100.

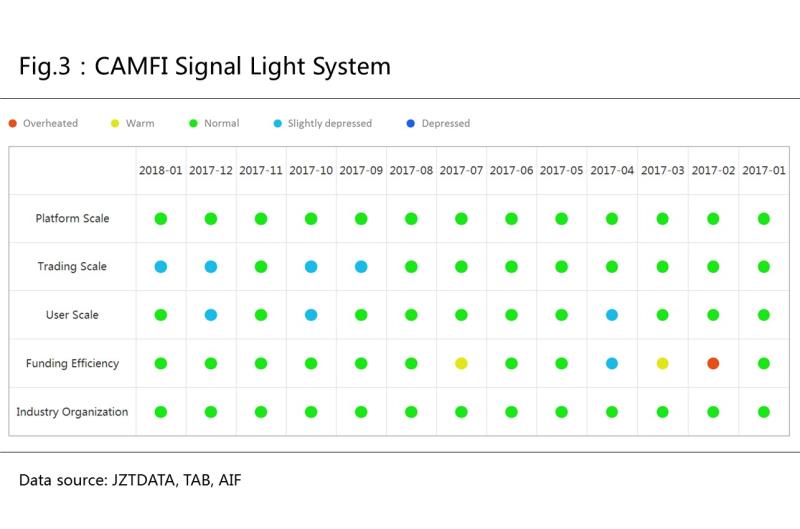

The Signal Light System shows the multi-attribute composition (Scale, Efficiency and Transparency) of CAMFI. In particular, in addition to the cold light of the Trading Scale, there was no obvious fluctuation among remaining dimensions of CAMFI.

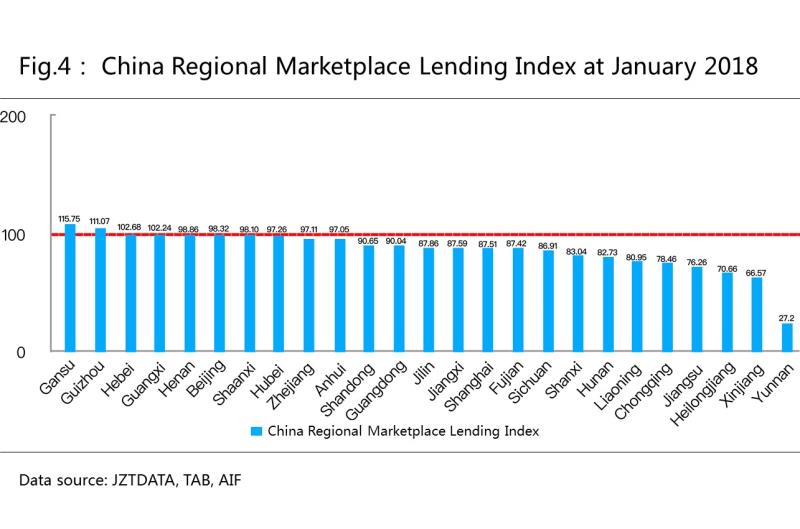

Provinces which had China Regional Marketplace Lending Index above 100: Gansu, Guizhou, Hebei and Guangxi.Other provinces got China Regional Marketplace Lending Index below 100, which was a signal of contraction.

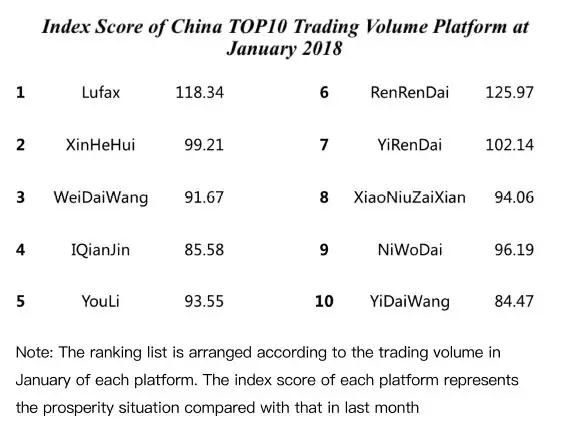

Note: The ranking list is arranged according to the trading volume in January of each platform. The index score of each platform represents the prosperity situation compared with that in last month.

Crowdfunding and Marketplace Finance Index (CAMFI)

Crowdfunding and Marketplace Finance Index (CAMFI) is a composite index consisting of Debt-Index, Rewards-Index, and Equity-Index. To track the health of crowdfunding platforms worldwide, we use Scale, Efficiency, and Transparency of the crowdfunding industry as three primary dimensions, and Platform Scale, Trading Scale, User Scale, Funding Efficiency, and Industry-Related Organization & Association as five secondary dimensions. Utilizing big data to conduct quantitative meta-analysis in all dimensions, we build a stable, comprehensive and highly representative indexing system for the global crowdfunding and marketplace finance industry. CAMFI always fluctuates around 100. An index score above 100 indicates improving health of the industry, while one that’s below 100 implies a contracting trend for the month being measured. The larger the index score, the greater the health improvement. The creation of CAMFI offers a measure of the crowdfunding industry for all stakeholders in the ecosystem, including both personal and institutional investors, as well as policy makers and governments.

01 About AIF

Academy of Internet Finance (AIF), Zhejiang University is headquartered in Hangzhou, one of the foremost FinTech hubs in China and the world. The first, and broadest, interdisciplinary research institute of its kind in China, AIF boasts the unrivaled connectivity with industry and government authorities. It has served as the founding presidency of Zhejiang Association of Internet Finance, alongside Ant Financial, a global FinTech leader. Since its inception in 2015, AIF has taken a global perspective with its academic boards as among the most international of its kind with members hailing from leading institutions in China and abroad. AIF Sinai Lab specializes in research and development of index products across a wide range of sectors, providing valuable insights for industry, government and academia. AIF Marketplace Lending Lab aims to take full advantage of its interdisciplinary nature to focus on the Marketplace lending industry worldwide, and provides fundamental data and decision reference for players, supervisors and consumers.

02 About Hangzhou JZTDATA Co., Ltd.

Hangzhou JZTDATA Co., Ltd. is a high-tech company based on large financial data and artificial intelligence. Since 2014, JZTDATA has collected information from more than 10000 financial platforms, 35000 related business, 1 million financial products and 10 millions related news. Based on big data and artificial intelligence algorithms, JZTDATA aim to help financial regulators on in-depth industry analysis and risk management, to give financial investors advices with one-stop services, to mine potential users for new financial management platforms, and to provide data services for financial agencies.

03 About TAB U.K.

TAB U.K. interprets billions of financial data points from thousands of crowdfunding and P2P platforms globally every day – allowing you to identify new opportunities and make better decisions within a disruptive asset class. We cover high growth debt, equity, rewards and other platform types across all geographies. Our service delivers powerful deal-level granularity and micro-to-macro analytics capabilities, with best-in-class data visualisation, personalisation, search and filter functionality built in.

For further information, please contact

AIF Sinai Lab Lv Jiamin Tel. +86-571-88208901 Email lvjiamin411@zju.edu.cn

| Hangzhou JZTDATA Co., Ltd. Mao Qingqing Tel. +86-571-87209876 Email service@jztdata.com |

TAB U.K. Craig Rowland Tel. +44 (0)1223 298855 Email craig@insidetab.io | CNFIN,Xinhua News Agency Jiang Nan Tel. +86-10-88051563 Email jiangnan@xinhua08.com.cn |

Copyright Notice

Crowdfunding and Marketplace Finance Index (CAMFI), is academically guided by Zhejiang University AIF, which is jointly launched and owned by Hangzhou JZTDATA Co., Ltd., and TAB U.K. CAMFI was released in London and Hangzhou simultaneously for the first time in July 24, 2017.

(Report writing Qian Xiaoxia Li Gege Li Duoduo)